Who Is Exempt From Illinois Income Tax . Personal exemption is $2,375 for the tax year 2022. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. In addition, illinois has what is called an exemption allowance, which is a set amount that most people. Define income that is exempt from illinois. Web illinois exemption allowance. Illinois does not have standard deduction. Web identify who is entitled to a subtraction of income exempt from illinois income tax. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on. Illinois has a 6.25% state. Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax.

from www.studocu.com

Define income that is exempt from illinois. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Illinois does not have standard deduction. Illinois has a 6.25% state. In addition, illinois has what is called an exemption allowance, which is a set amount that most people. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on. Personal exemption is $2,375 for the tax year 2022. Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax. Web illinois exemption allowance. Web identify who is entitled to a subtraction of income exempt from illinois income tax.

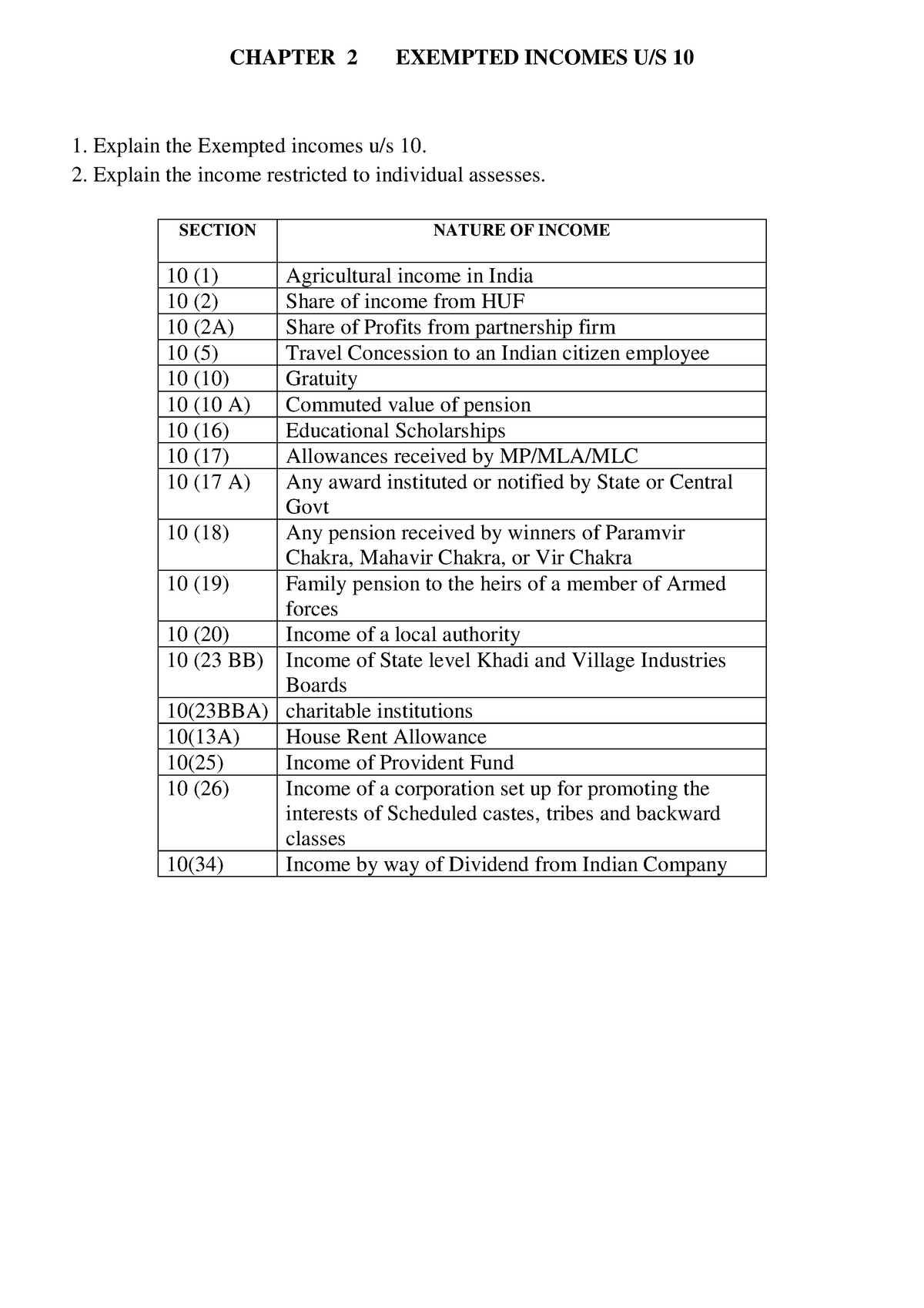

tax notes CHAPTER 2 EXEMPTED U/S 10 Explain the

Who Is Exempt From Illinois Income Tax Web identify who is entitled to a subtraction of income exempt from illinois income tax. Personal exemption is $2,375 for the tax year 2022. Illinois has a 6.25% state. In addition, illinois has what is called an exemption allowance, which is a set amount that most people. Web illinois exemption allowance. Define income that is exempt from illinois. Web identify who is entitled to a subtraction of income exempt from illinois income tax. Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Illinois does not have standard deduction. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on.

From www.signnow.com

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF Who Is Exempt From Illinois Income Tax Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Illinois does not have standard deduction. Illinois has a 6.25% state. Personal exemption. Who Is Exempt From Illinois Income Tax.

From www.dochub.com

Illinois tax exempt form Fill out & sign online DocHub Who Is Exempt From Illinois Income Tax Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Define income that is exempt from illinois. In addition, illinois has what is called an exemption allowance, which is a set amount that most people. Web social security benefits and railroad retirement benefits are also. Who Is Exempt From Illinois Income Tax.

From penniazrosemary.pages.dev

W4 Form 2024 Spanish Version Margi Saraann Who Is Exempt From Illinois Income Tax Define income that is exempt from illinois. Web illinois exemption allowance. Personal exemption is $2,375 for the tax year 2022. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Web social security benefits and railroad retirement benefits are also exempt from illinois state income. Who Is Exempt From Illinois Income Tax.

From quizzdbbackovnc.z13.web.core.windows.net

Are Texas Schools Exempt From Sales Tax Who Is Exempt From Illinois Income Tax Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on. Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions,. Who Is Exempt From Illinois Income Tax.

From www.pdffiller.com

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank Who Is Exempt From Illinois Income Tax Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Illinois has a 6.25% state. Web illinois exemption allowance. Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax. In addition, illinois has what is called an exemption allowance,. Who Is Exempt From Illinois Income Tax.

From ecurrencythailand.com

Which Of The Following Is Exempted? The 9 Latest Answer Who Is Exempt From Illinois Income Tax Personal exemption is $2,375 for the tax year 2022. Define income that is exempt from illinois. Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax. Illinois does not have standard deduction. In addition, illinois has what is called an exemption allowance, which is a set amount that most people. Illinois has a 6.25%. Who Is Exempt From Illinois Income Tax.

From lasopaherbal363.weebly.com

Tax exempt status illinois template 2016 lasopaherbal Who Is Exempt From Illinois Income Tax Illinois has a 6.25% state. Personal exemption is $2,375 for the tax year 2022. Illinois does not have standard deduction. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Web illinois exemption allowance. Web social security benefits and railroad retirement benefits are also exempt. Who Is Exempt From Illinois Income Tax.

From www.wallstreetmojo.com

Tax Exempt Meaning, Examples, Organizations, How it Works Who Is Exempt From Illinois Income Tax Personal exemption is $2,375 for the tax year 2022. Web identify who is entitled to a subtraction of income exempt from illinois income tax. Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income. Who Is Exempt From Illinois Income Tax.

From www.slideshare.net

Lecture 4 exempt from tax Who Is Exempt From Illinois Income Tax Web illinois exemption allowance. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Define income that is exempt from illinois. Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax. Web if you received wages, salaries, tips, and. Who Is Exempt From Illinois Income Tax.

From www.slideshare.net

Exempted from Tax Who Is Exempt From Illinois Income Tax Illinois has a 6.25% state. Illinois does not have standard deduction. Web identify who is entitled to a subtraction of income exempt from illinois income tax. In addition, illinois has what is called an exemption allowance, which is a set amount that most people. Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax.. Who Is Exempt From Illinois Income Tax.

From fawniaysimone.pages.dev

Tax Exempt Form 2024 Printable Row Leonie Who Is Exempt From Illinois Income Tax Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax. Illinois does not have standard deduction. Illinois has a 6.25% state. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Web illinois exemption allowance. Define income that is. Who Is Exempt From Illinois Income Tax.

From www.pdffiller.com

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller Who Is Exempt From Illinois Income Tax Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Web illinois exemption allowance. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on. Web social security benefits and railroad retirement benefits are. Who Is Exempt From Illinois Income Tax.

From www.sanpatricioelectric.org

Tax Exempt Forms San Patricio Electric Cooperative Who Is Exempt From Illinois Income Tax Web identify who is entitled to a subtraction of income exempt from illinois income tax. Illinois does not have standard deduction. In addition, illinois has what is called an exemption allowance, which is a set amount that most people. Illinois has a 6.25% state. Web here's what you need to know about the illinois state income tax, from the state's. Who Is Exempt From Illinois Income Tax.

From news.illinoisstate.edu

2018 exempt Form W4 News Illinois State Who Is Exempt From Illinois Income Tax In addition, illinois has what is called an exemption allowance, which is a set amount that most people. Define income that is exempt from illinois. Illinois has a 6.25% state. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on. Web here's what you need to know about. Who Is Exempt From Illinois Income Tax.

From www.studocu.com

List of Exempted sec 10 List of Exempted (Tax Free Who Is Exempt From Illinois Income Tax Web identify who is entitled to a subtraction of income exempt from illinois income tax. Illinois does not have standard deduction. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on. Web here's what you need to know about the illinois state income tax, from the state's flat. Who Is Exempt From Illinois Income Tax.

From www.studocu.com

tax notes CHAPTER 2 EXEMPTED U/S 10 Explain the Who Is Exempt From Illinois Income Tax Illinois does not have standard deduction. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Personal exemption is $2,375 for the tax. Who Is Exempt From Illinois Income Tax.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF Who Is Exempt From Illinois Income Tax Web social security benefits and railroad retirement benefits are also exempt from illinois state income tax. Illinois has a 6.25% state. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to pay illinois income tax on. Illinois does not have standard deduction. Define income that is exempt from illinois. Web here's what you. Who Is Exempt From Illinois Income Tax.

From www.pdffiller.com

Tax Exempt Form Ny Fill Online, Printable, Fillable, Blank PDFfiller Who Is Exempt From Illinois Income Tax Personal exemption is $2,375 for the tax year 2022. Web here's what you need to know about the illinois state income tax, from the state's flat tax rate to available deductions, credits, and exemptions. Illinois has a 6.25% state. Web illinois exemption allowance. Web if you received wages, salaries, tips, and commissions from illinois employers, you are not required to. Who Is Exempt From Illinois Income Tax.